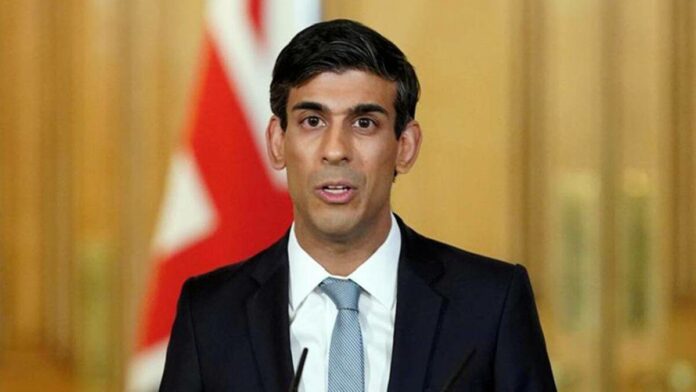

Read the complete write-up of Rishi Sunak net worth, age, wife, children, height, family, parents, wealth as well as other information you need to know.

Introduction

Rishi Sunak is a British politician. He is currently serving as Chancellor of the Exchequer since 2020, having previously served as Chief Secretary to the Treasury from 2019 to 2020. A member of the Conservative Party, he has been a Member of Parliament (MP) for Richmond (Yorks) since 2015. After graduating, he worked for Goldman Sachs and later as a partner at the hedge fund firms The Children’s Investment Fund Management and Theleme Partners.

Sunak served in Theresa May’s second government as Parliamentary Under-Secretary of State for Local Government after being elected for Richmond (Yorks) at the 2015 general election. He voted three times in favour of May’s Brexit withdrawal agreement. After May resigned, Sunak was a supporter of Boris Johnson’s campaign to become Conservative leader. After Johnson was elected and appointed Prime Minister, he appointed Sunak as Chief Secretary to the Treasury. Sunak replaced Sajid Javid as Chancellor of the Exchequer after his resignation in February 2020. As Chancellor, he has been prominent in the government’s economic response to the economic impact of the COVID-19 pandemic in the United Kingdom.

Early life

| Name | Rishi Sunak |

| Net Worth | $400 million |

| Occupation | Politician, Business executive |

| Height | 1.83m |

| Age | 41 years |

Rishi Sunak was born on May 12, 1980 (age 41 years) in Southampton, United States. He is the son of Indian parents Yashvir and Usha Sunak who had emigrated from East Africa. He is the eldest of three siblings. His father Yashvir was born and raised in the Colony and Protectorate of Kenya, while his mother Usha was born in Tanganyika (which later became part of Tanzania). His grandparents were born in Punjab Province, British India, and emigrated from East Africa with their children to the UK in the 1960s. Yashvir was a general practitioner, and Usha was a pharmacist who ran a local pharmacy.

Sunak’s brother Sanjay is a psychologist. His sister Raakhi works as the Head of Humanitarian, Peacebuilding, UN Funds & Programmes at the Foreign, Commonwealth and Development Office. He is close friends with The Spectator’s political editor James Forsyth, whom he has known since their schooldays at Winchester College. Sunak was the best man at Forsyth’s wedding to the journalist Allegra Stratton, and they are godparents to each other’s children

He attended Stroud School in Romsey, Hampshire and Winchester College, a boys’ independent boarding school, where he was head boy and the editor of the school paper. He waited tables at a curry house in Southampton during his summer holidays. He studied Philosophy, Politics and Economics at Lincoln College, Oxford, graduating with a first in 2001. During his time at the university, he undertook an internship at Conservative Campaign Headquarters. In 2006, he obtained an MBA from Stanford University, where he was a Fulbright scholar.

Rishi Sunak worked as an analyst for the investment bank Goldman Sachs between 2001 and 2004. He then worked for the hedge fund management firm The Children’s Investment Fund Management, becoming a partner in September 2006. He left in November 2009 in order to join former colleagues at a new hedge fund firm, Theleme Partners, which launched in October 2010 with $700 million under management. He was also a director of the investment firm Catamaran Ventures, owned by his father-in-law, Indian businessman N. R. Narayana Murthy.

Political career

Rishi Sunak was selected as the Conservative candidate for Richmond (Yorks) in October 2014. The seat had previously been held by William Hague, a former leader of the party, Foreign Secretary and First Secretary of State, who chose to stand down at the following general election. The seat is one of the safest Conservative seats in the United Kingdom and has been held by the party for over 100 years. In the same year, Sunak was head of the Black and Minority Ethnic (BME) Research Unit of center-right think tank Policy Exchange, for which he co-wrote a report on BME communities in the UK.

Sunak was elected as MP for the constituency at the 2015 general election with a majority of 19,550 (36.2%). During the 2015–2017 parliament he was a member of the Environment, Food and Rural Affairs Select Committee. Sunak supported the UK leaving the European Union in the June 2016 membership referendum. That year, he wrote a report for the Centre for Policy Studies (a Thatcherite think tank) supporting the establishment of free ports after Brexit, and the following year wrote a report advocating the creation of a retail bond market for small and medium-sized enterprises.

Check Out: Liz Truss net worth

He was re-elected at the 2017 general election, with an increased majority of 23,108 (40.5%). He served as Parliamentary Under-Secretary of State for Local Government between January 2018 and July 2019. Sunak voted for then-Prime Minister Theresa May’s Brexit withdrawal agreement on all three occasions and voted against a referendum on any withdrawal agreement. He supported Boris Johnson in the 2019 Conservative Party leadership election and co-wrote an article in The Times newspaper with fellow MPs Robert Jenrick, and Oliver Dowden to advocate for Johnson during the campaign in June.

Rishi Sunak was appointed as Chief Secretary to the Treasury by Prime Minister Boris Johnson on 24 July 2019, serving under Chancellor Sajid Javid. He became a member of the Privy Council the next day. He was re-elected in the 2019 general election with an increased majority of 27,210 (47.2%). During the election campaign, Sunak represented the Conservatives in both the BBC’s and ITV’s seven-way election debates.

Chancellor of the Exchequer

In the weeks leading up to Sunak’s appointment as Chancellor of the Exchequer, a number of briefings in the press had suggested that a new economic ministry led by Sunak might be established, to reduce the power and political influence of Chancellor Sajid Javid at the Treasury. Sunak was considered to be a Johnson loyalist, favored by Dominic Cummings, and seen as the “rising star” minister who had ably represented the Prime Minister during the 2019 election debates. By February 2020, it was reported by The Guardian that Javid would remain in his role as Chancellor and that Sunak would stay on as Chief Secretary to the Treasury, in order for the Prime Minister’s Chief Adviser, Cummings, to “keep an eye” on Javid.

Sunak was promoted to Chancellor on 13 February 2020 as part of a cabinet reshuffle, after the resignation of his predecessor, Javid, on the same day. Javid had resigned as Chancellor of the Exchequer following a meeting with Prime Minister Johnson. During the meeting, Johnson had offered to keep his position on the condition that he dismisses all of his advisers at the Treasury, to be replaced with individuals selected by Cummings. Upon resigning, Javid told the Press Association that “no self-respecting minister would accept those terms”. Some political commentators saw Sunak’s appointment as signaling the end of the Treasury’s independence from Downing Street, with Robert Shrimsley, chief political commentator of the Financial Times, arguing that “good government often depends on senior ministers – and the Chancellor in particular – being able to fight bad ideas”.

His first budget took place on 11 March 2020. This included an announcement of £30 billion of additional spending, of which £12 billion was allocated for mitigation of the economic impact of the COVID-19 pandemic. As the pandemic generated a financial impact, Chancellor Sunak’s measures received criticism as some workers were unable to qualify for the Treasury’s income support measures. The acting leader of the Liberal Democrats, Sir Ed Davey, said that people were being unfairly “hung out to dry”, with “their dream jobs turning into nightmares” after hundreds of MPs contacted the Chancellor. The Institute for Employment Studies estimated that 100,000 people could not be eligible for any type of government help as they started a new job too late to be included in the job retention scheme, while the British Hospitality Association informed the Treasury Select Committee that between 350,000 and 500,000 workers in its sector were not eligible.

Job retention scheme

On 17 March, Sunak announced £330 billion in emergency support for businesses, as well as a furlough scheme for employees. This was the first time a British government had created such an employee retention scheme. The scheme was announced on 20 March 2020 as providing grants to employers to pay 80% of a staff wage and employment costs each month, up to a total of £2,500 per person per month. The cost has been estimated at £14 billion a month to run.

The Coronavirus Job Retention Scheme initially ran for three months and was backdated to 1 March. Following a three-week extension of the countrywide lockdown, the scheme was extended by Sunak until the end of June 2020. At the end of May, Sunak extended the scheme until the end of October 2020. The decision to extend the job retention scheme was made to avoid or defer mass redundancies, company bankruptcies and potential unemployment levels not seen since the 1930s. After the second lockdown in England was announced on 31 October 2020, a further extension was announced until 2 December 2020, this was followed on 5 November 2020 by a lengthy extension until 31 March 2021. A further extension until 30 April 2021 was announced by Sunak on 17 December 2020. In the 2021 United Kingdom budget held on 3 March 2021, Sunak confirmed that the scheme had been extended once more until 30 September 2021.

Following changes to the scheme at the end of May, the director of the Northern Ireland Retail Consortium said that being asked to pay wages when businesses had not been trading was an added pressure, while the Federation of Small Businesses was surprised that the Chancellor had announced a tapering of the scheme when ending it. Northern Ireland’s economy minister Diane Dodds said that changes to the scheme could be very difficult for some sectors uncertain about when they can reopen, particularly in the hospitality and retail sector, whilst finance minister Conor Murphy said that it was too early in the economic recovery. By 15 August 80,433 firms had returned £215,756,121 that had been claimed under the scheme. Other companies had claimed smaller amounts of grant cash on the next installment to compensate for any overpayment. HM Revenue and Customs officials believed that £3.5 billion may have been paid out in error or to fraudsters.

In July, he unveiled a plan for a further £30 billion of spending which included a stamp duty holiday, a cut to VAT for the hospitality sector, the Eat Out to Help Out scheme, and a job retention bonus for employers. Eat Out to Help Out was announced to support and create jobs in the hospitality industry. The government-subsidized food and soft drinks at participating cafes, pubs and restaurants at 50%, up to £10 per person. The offer was available from 3 to 31 August on Monday to Wednesday each week. In tot al, the scheme subsidized £849 million in meals. Some consider the scheme to be a success in boosting the hospitality industry, however, others disagree. In terms of the COVID-19 pandemic, a study at the University of Warwick found that the scheme contributed to a rise in COVID-19 infections of between 8% and 17%.

In an Ipsos MORI poll in September 2020, Sunak had the highest satisfaction score of any British Chancellor since Labour’s Denis Healey in April 1978. On 26 September, Sunak was said to have opposed a second lockdown with the threat of his resignation, due to what he saw as the dire economic impacts it would have and the responsibility he would have to suffer for that.

In his March 2021 budget, he announced that the deficit had risen to £355 billion in the fiscal year 2020/2021, the highest in peacetime. The budget included an increase in the rate of corporation tax from 19% to 25% in 2023, a five-year freeze in the tax-free personal allowance and the higher rate income tax threshold, and the extension of the furlough scheme until the end of September. Sunak was the first Chancellor to raise the corporation tax rate since Healey in 1974.

In June 2021, at the G7 summit hosted by Sunak at Lancaster House in London, a tax reform agreement was signed, which in principle, sought to establish a global minimum tax on multinationals and online technology companies. In October 2021, the OECD signed an accord to join the tax reform plan.

Register of ministers’ interests

In November 2020, Sunak was reported by The Guardian to have not declared a significant amount of his wife and family’s financial interests on the register of ministers’ interests, including a combined £1.7 billion shareholding in the Indian company Infosys. Sunak is required under the ministerial code to declare interests that are “relevant” to his responsibilities and “which might be thought to give rise to a conflict” with his public duties. A Treasury spokesperson said that Sunak “followed the ministerial code to the letter in his declaration of interests”. The Labour MP Tonia Antoniazzi wrote to Lord Evans, chair of the Committee on Standards in Public Life, to assess whether the ministerial code was breached by Sunak.

Cost of living crisis

In October 2021, Sunak unveiled his third budget. It included substantial spending promises to a large extent related to science and education. Sunak gave his spring statement on 23 March 2022. He said that the recovery from the COVID-19 pandemic had been disrupted by the Russian invasion of Ukraine. He cut fuel duty, removed VAT on energy-saving equipment (such as solar panels and insulation) and reduced national insurance payments for small businesses and while continuing with a planned national insurance rise in April he promised to align the primary threshold with the basic personal income allowance as of July. He also promises a reduction in income tax in 2024. The Office for Budget Responsibility said that the tax burden would reach its highest level since the 1940s. Sunak also provided some funding to help vulnerable people cope with the rising cost of living, however, most political commentators and consumer groups considered the response insufficient.

Spouse’s non-domiciled status to avoid UK taxes

Following the Russian invasion, Rishi Sunak has come under criticism for his wife, Akshata Murthy’s financial shares in Infosys (founded by Akshata’s father, N. R. Narayana Murthy), which has continued its presence in Russia since the invasion of Ukraine. The company has links with Russia and its president Vladimir Putin. Murthy also has applied for and been granted non-domiciled status, meaning that she does not have to pay tax on income earned abroad despite living in the UK, avoiding an estimated £20 million in taxes. She pays around £30,000 to secure non-domicile status and refuses to say where she pays tax.

Check Out: Dominic Raab net worth

Sunak arrived in public discourse from relative obscurity at the start of 2020. In the early stages of the COVID-19 pandemic, he was very popular by the standards of British politics, being described by one analyst as having “better ratings than any politician since the heydays of Tony Blair”. Various polling suggested he maintained this position throughout 2020. Sunak developed something of a cult media following with jokes and gossip about him being sexually attractive becoming widespread on social media and in magazines.

Wife

Rishi Sunak is married to Akshata Murthy, they had their wedding in 2009. His wife is the daughter of the Indian billionaire N. R. Narayana Murthy, the founder of Infosys, in August 2009. Akshata Murthy owns a 0.91% stake in Infosys, which is valued at about $900m (£690m), as of April 2022. Infosys continued to operate in Russia following Russia’s 2022 invasion of Ukraine, which led to criticism of Sunak and his family, but in April Infosys announced it was closing its Russian office. Murthy’s status as “non-domiciled” for tax purposes caused controversy when The Independent revealed that she had reduced her tax burden by “around £4.4m”.

Sunak met his wife Akshata Murthy while studying at Stanford University; they have two daughters. Akshata is a director of her father’s investment firm, Catamaran Ventures, and also manages her own fashion label. Her shares in Catamaran are worth £430m, making her one of the wealthiest women in Britain. They live in the village of Kirby Sigston, near Northallerton, North Yorkshire. They also own a house in Kensington in central London, a flat on the Old Brompton Road, London, and a penthouse apartment in Santa Monica, California.

Rishi Sunak net worth

How much is Rishi Sunak worth? Rishi Sunak net worth is estimated at around $400 million. His main source of income is from his career as a politician and business executive. Sunak successful career has earned him some luxurious lifestyles and some fancy cars trips. He is one of the richest and influential politicians in the United Kingdom. However, Sunak is a Hindu and has taken his oath at the House of Commons on the Bhagavad Gita since 2017. He is a teetotaller. He was previously a governor of the East London Science School. Public attitudes towards Sunak remained broadly positive in 2021, though his popularity declined steadily over time. By early 2022, with the cost of living becoming a growing focus of public concern, Sunak’s response was perceived to be inadequate and he received some of his lowest ever approval ratings.